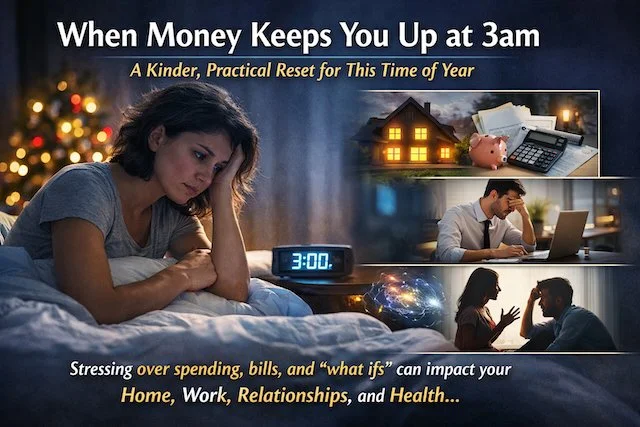

When Money Keeps You Up at 3am: A Kinder, Practical Reset for This Time of Year from Phill Holdsworth, AurumGold

Phill Holdsworth, founder of AurumGold and Chamber President, understands that as we navigate the first weeks of the new year, many in our business community are feeling a familiar 'January hangover'.

This is a period where the festive high over Christmas often meets the sobering reality of the bank balance in January. Phill has kindly provided an article exploring this topic, and how we can move forward confidently with our relationship with money to ensure a steadier, less stressful 2026.

Phill explains how financial stress impacts our health, our homes, and our performance at work, while introducing a practical, shame-free framework for understanding your own money mindset.

When Money Keeps You Up at 3am

January can turn money into something bigger than numbers. The pressure of December often transforms into a cocktail of post-holiday guilt, pride, and a lingering sense of "how did it come to this?"

If you’ve been lying awake at 3am replaying the decisions of last month - or staring at a bank statement with a sense of dread - you’re not broken. You’re human. Money stress doesn’t stay contained in your bank account; it spills into your home, your work, your relationships, and your physical health.

Why the "January Hangover" hits so hard

During the festive season, many of us were chasing emotional needs that don't actually carry a price tag:

Belonging: The fear of being the one who didn't provide enough.

Validation: Proving we are "good enough" as a parent, partner, or friend.

Safety: Trying to buy a sense of control in a chaotic season.

Relief: Using spending as a temporary lift from year-end exhaustion.

Now that the decorations are down, the "shortcut to comfort" we took in December can create a punishing loop: regret over spending → anxiety about the future → the urge to spend again just to numb the worry.

The Real Impact: Home, Work, Relationships, and Health

At home: money tension shows up as snappiness, silence, or parent guilt.

At work: worry steals focus and patience, and can quietly chip away at confidence.

In relationships: money becomes a proxy fight — not about £40, but about feeling judged, unsafe, or alone.

In your mind and body: chronic stress isn’t just emotional; it affects sleep, digestion, decision-making, and energy.

Money Habitudes: a quick, no-shame way to understand your money wiring

If you want something genuinely practical (without spreadsheet-shame), Money Habitudes is a strong starting point.

What it is

Money Habitudes is a simple, game-like tool that helps you spot the why behind your money decisions — the habits and attitudes running in the background. It’s built to make money conversations easier and less loaded.

How the online version works

The online version is designed to be fast and straightforward — typically around 10 minutes — and it produces an individual Client Habitude Report you can actually work with.

In plain English, you:

respond to 54 money-related statements by sorting them into:

That’s me

Sometimes / it depends

That’s not me

then the report breaks your results down across six common tendencies:

Giving, Planning, Status, Security, Carefree, Spontaneous.

There’s no “pass” or “fail”. The value is in seeing your pattern clearly — especially when stress is pushing you into autopilot.

Why this helps at this time of year

Because it turns the fog into something you can name:

“I’m chasing security because everything feels uncertain.”

“I’m leaning into spontaneous spending because I’m exhausted.”

“I’m stuck in status pressure and I hate admitting it.”

“I’m overusing giving because I’m trying to prove love.”

That “Oh… that’s what’s going on” moment is often the start of real change.

How I can help you make sense of it all (and what we do at AurumGold)

Tools are powerful — but most people don’t need more information. They need help turning insight into calmer, repeatable habits.

That’s where I come in. At AurumGold, my work focuses on financial wellbeing through a mindset-led approach: understanding what drives your decisions, reducing money anxiety, and building practical routines you can stick to.

Money Coaching for individuals

If money is keeping you up at 3am, coaching gives you a confidential space to:

understand your Money Habitudes results (without judgement)

identify triggers (spending, avoiding, people-pleasing, panic)

set simple boundaries and a plan that fits real life

build confidence and steadier decision-making week to week

Money Coaching for couples

Most couples don’t argue about money because they’re “bad with money”. They argue because money hits deeper stuff: safety, fairness, control, respect, fear.

Using Money Habitudes as the starting point, I help couples:

understand each other’s money wiring (and stop taking it personally)

replace blame with clearer agreements

create practical rules that reduce conflict (spending limits, shared priorities, “how we decide”)

Money Coaching for employees and workplaces

Money stress doesn’t stay at home. It affects focus, confidence, relationships at work, and resilience.

Through workplace support (workshops and 1-to-1 help), AurumGold supports employers who want a healthier, steadier workforce — not through lectures, but through practical tools and human conversations.

Want to talk it through?

If you’d like support with Money Habitudes Online — or you simply want to stop the spiral and get steady again